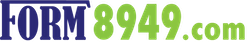

"Intelligent" Form 8949 Statements

The Form 8949 app generates "Intelligent Form 8949 Statements".

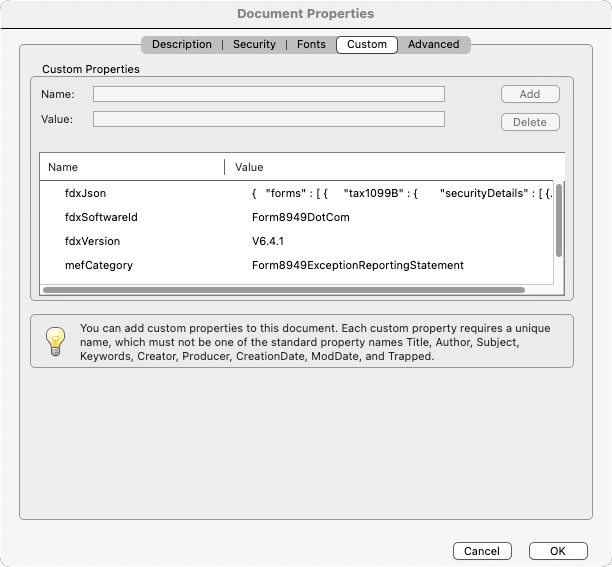

By uploading an "Intelligent Form 8949 Statement" to tax software, a taxpayer or tax preparer can fulfill the tax reporting requirements for transactions reportable on Form 8949 in ONE STEP.

EXPLANATION

Form 8949 Statements are also known as Form 8949 Exception 2 Statements.

The IRS instructions describe "Exception 2" as follows:

Instead of reporting each of your transactions on a separate row of Form 8949 Part I or II,

you can report them on an attached statement

containing all the same information as Parts I and II and in a similar format.

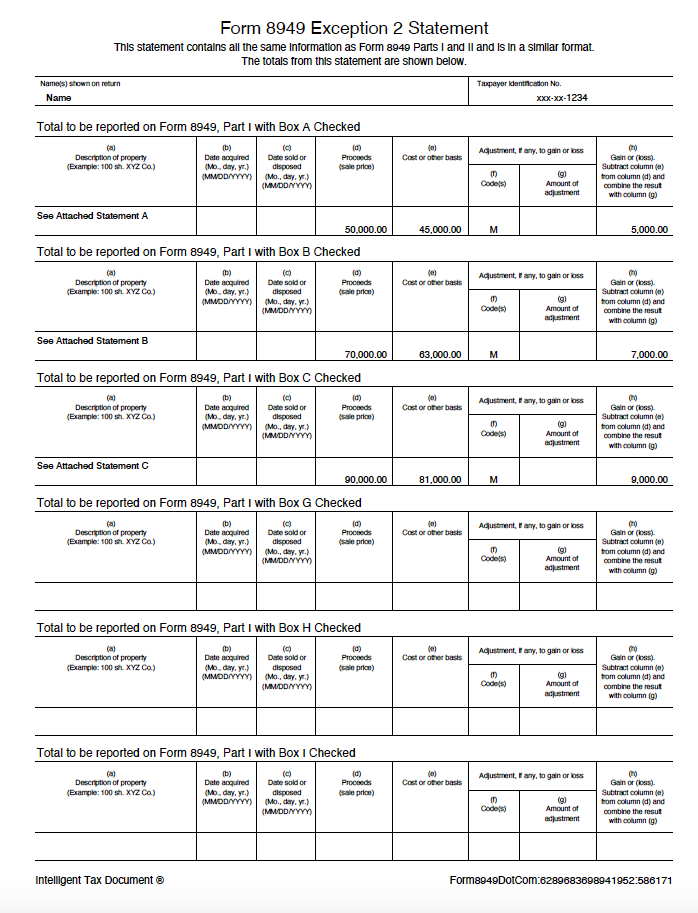

"Intelligent" Form 8949 Statements include the statement data in the document properties in industry-standard JSON (Java Script Object Notation) format.

In the case of Form 8949 Statements the embedded data consists of the "summary transactions" that should be reported on Form 8949 with code "M" referencing the attached statement.

Example Embedded Data (fdxJson Custom Document Property Value using V6.4.1)

{

"forms": [

{

"tax1099B": {

"securityDetails": [

{

"checkboxOnForm8949": "A",

"saleDescription": "See Attached Statement A",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"salesPrice": 10000.00,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 9000.00

},

{

"checkboxOnForm8949": "B",

"saleDescription": "See Attached Statement B",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"salesPrice": 20000.00,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 18000.00

},

{

"checkboxOnForm8949": "C",

"saleDescription": "See Attached Statement C",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"salesPrice": 30000.00,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 27000.00

},

{

"checkboxOnForm8949": "D",

"saleDescription": "See Attached Statement D",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"salesPrice": 40000.00,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 36000.00

},

{

"checkboxOnForm8949": "E",

"saleDescription": "See Attached Statement E",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"salesPrice": 50000.00,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 45000.00

},

{

"checkboxOnForm8949": "F",

"saleDescription": "See Attached Statement F",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"salesPrice": 60000.00,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 54000.00

}

]

},

"tax1099Da": {

"digitalAssetDetails": [

{

"checkboxOnForm8949": "G",

"digitalAssetName": "See Attached Statement G",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"proceeds": 70000.00,

"costBasis": 63000.00,

"basisReported": true,

"longOrShort": "SHORT"

},

{

"checkboxOnForm8949": "H",

"digitalAssetName": "See Attached Statement H",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"proceeds": 80000.00,

"costBasis": 72000.00,

"basisReported": false,

"longOrShort": "SHORT"

},

{

"checkboxOnForm8949": "I",

"digitalAssetName": "See Attached Statement I",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"proceeds": 90000.00,

"costBasis": 81000.00,

"basisReported": false,

"longOrShort": "SHORT"

},

{

"checkboxOnForm8949": "J",

"digitalAssetName": "See Attached Statement J",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"proceeds": 100000.00,

"costBasis": 90000.00,

"basisReported": true,

"longOrShort": "LONG"

},

{

"checkboxOnForm8949": "K",

"digitalAssetName": "See Attached Statement K",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"proceeds": 110000.00,

"costBasis": 99000.00,

"basisReported": false,

"longOrShort": "LONG"

},

{

"checkboxOnForm8949": "L",

"digitalAssetName": "See Attached Statement L",

"variousDatesAcquired": true,

"dateOfSale": "2025-12-31",

"proceeds": 120000.00,

"costBasis": 108000.00,

"basisReported": false,

"longOrShort": "LONG"

}

]

}

}

],

"attributes": []

}

Note: V6.4.1 does not include adjustmentCodes property for DigitalAssetDetails. Code M adjustment code needs to be inferred.

TAX SOFTWARE REQUIREMENTS

1) Inspect document properties.

2) Make note of 'mefCategory'. Treat PDF as uploaded for e-file attachment.

3) Extract 'fdxJson' property value.

4) Deserialize JSON.

5) Add 'See Attached' transactions to tax return.

Contact us at support@form8949.com for more information.