List of Supported Brokers and Supported Data File Formats

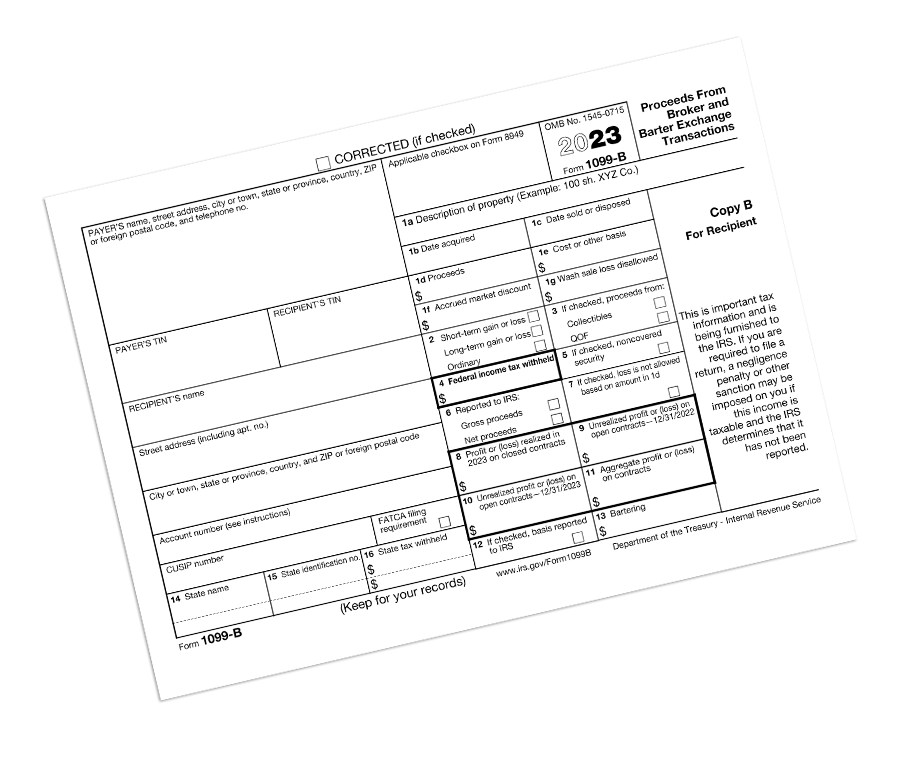

Brokers are required to provide you Form 1099-B or an approved facsimile each year in a human-readable format.

Data File Formats

As stated above, your broker is REQUIRED to provide you Form 1099-B or a facsimile in a human-readable format.

Your broker SHOULD also provide Form 1099-B data in a computer-readable format.

Unfortunately, many brokers do not do so.

Our app can process 1099-B data files in the formats listed below.

1099-B data includes realized gain or loss information plus any adjustments for the wash sale rules.

Note: Our app cannot process raw trade data files (a record of buys, sells, etc.)

in a "Standard Computer-Readable Format" (FDX JSON, OFX, XML, or TXF)

Standard

Computer-Readable

Formats

FDX JSON: Financial Data Exchange JavaScript Object Notation format. The newest modern standard for financial and tax data communication.

OFX: Some brokers sponsor an accessible Open Financial Exchange (OFX) server from which applications can retrieve your data in a standard XML format in your behalf. Our application can interact with these servers. Other brokers sponsor an OFX server but limit access to specific OFX clients.

XML: Extensible markup language. A downloadable data file in the same standard format used by OFX servers.

TXF: Tax exchange format (TXF) files contain 1099-B data in a older, less-robust, albeit standard format.

Non-standard

Computer-Readable

Formats

CSV: Comma separated values. A text file where data is presented in rows and columns. There is no standard CSV format for 1099-B data. Each broker uses a different proprietary approach. As such, our app needs to provide custom code to read and process these files.

XLS: Microsoft Excel format. Data is presented in cells arranged in rows and columns. As with CSV, there is no standard XLS format for 1099-B data. Each broker uses a different proprietary approach. As such, our app needs to provide custom code to read and process these files.

Non-standard Human and

Sometimes-Computer-Readable Formats

PDF: Portable Document Format. Instead of mailing you Form 1099-B, your broker will allow you to download the form as PDF. We can often — but not always — parse (read with a computer program) and process downloaded PDF files.

Specifically we cannot process:

- PDF files generated by scanning paper 1099-Bs

- PDF files that are password protected

- PDF files containing "rasterized" text. Normally PDF files contain "vector" information. Vectors allow for presenting the PDF in any size and preserves the quality of the content. Rasterized PDFs convert the content to an image and show jagged edges on letters at large sizes.

- PDF files that use a non-standard encoding of text.

Brokers

For information specific to a broker,

click on the link in the Broker Name column below.

If your broker is not listed,

please email us.

If you have more up-to-date information,

let us know.

As stated above, the

Standard

Computer-Readable

Formats

of FDX,

OFX, XML, and TXF

are preferred over the

Non-standard Formats (CSV, XLS, and PDF).

#

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

Name

Site

FDX

OFX

XML

TXF

CSV

XLS

NONE